Contemplating this chart this morning...

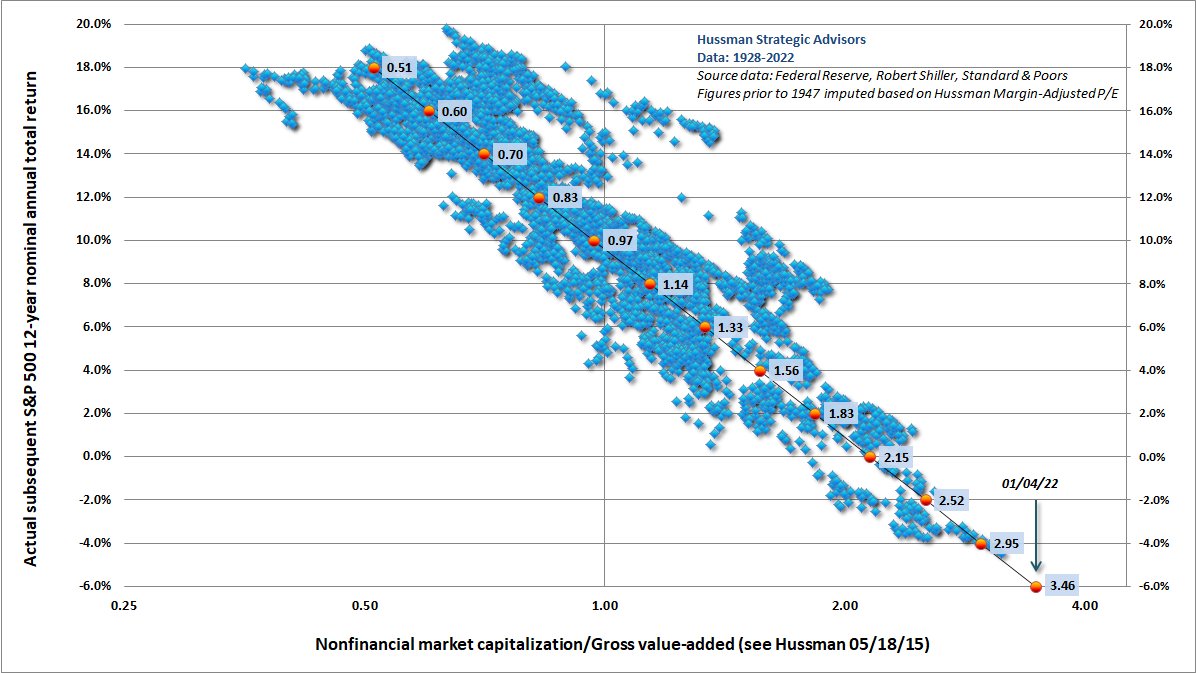

The X-Axis NMC/GVA is just a more technical, slightly more accurate version of the Buffett Indicator ratio. But they are both telling the same story.

1.0-1.2 is reasonable historically. Higher that that and you are not likely to see real returns above average inflation over the subsequent 10-12 years.

This chart suggest that 12 years from now, the stock valuations will still be -6% lower than they are today. One scenario is the market doesn't crash but slowly declines 6% over the next 12 years. I think that scenario is highly unlikely. Todays investors are nuts, but they are greedy and nuts. In that scenario they would have gotten out way before that. If they can. An a slow gradual decline gives them that flexibility. They aren't going to sit and hold slowly declining risk assets for a decade without losing patience. They'll take a bit of a trim, but they can make that up by getting their principle out and into better earning assets.

What historically happens is a massive and quick crash occurs (when the smart-money decided the game is no longer worth the candle). Joe retail investor dollar-cost-averaging is paycheck into the market like he is told to, never selling, like he is told not to, ends up being the bag-holder. Goldman-Sachs can't get their money out without the retail bag-holders willing to buy at these levels. Stocks don't sell to themselves. There has to be a bag-holder for smart-money to get out at the top. bag-holders are NOT immoral or stupid. They are just average folks who DCA their checks while raising kids and living their life. They don't obsess over this stuff and don't see it coming and CNBC will never tell them. CNBC will only ever tell you to keep buying and never sell. Once the crash happens, bag-holders are stuck. They can't sell without locking in their 60% loss. But if they don't, their investment is locked for 12+ years , or until they can get to some level of loss they can stomach. After that crash the market will start to claw it's way back, but 12 years from now might not have year gotten back to where it started. The NASDAQ took 15 years to recover from 2001. But after the initial crash, there are good invests for new money in those remain 10 years. You just don't want to be a bag-holder for Goldman-Sachs. The market in aggregate won't be back up to these levels in 12 years, but they will be up quite a bit from the low point after the initial crash.

If they are young enough (20-30yo), they can still work and put new money in the market after the crash (2 years?) at the point that the market reaches reasonable levels and starts to rise again, hopefully at more reasonable and sustainable rate. They'll still have decades to make up the difference. Retirees or Near-Retirees are screwed.

Goldman-Sachs will still payout record bonuses those years. Even if they get caught flat-footed (and they won't), they have high speed trading systems that will get their sell orders in front-loaded ahead of any retail investors sell off.

There is a reason Buffett is sitting on his largest pile of un-invested cash in Berkshire's history. He may look like he is grinning like a baby, but that is really just a gator licking his chops.