Or will 2007 look like child's play?

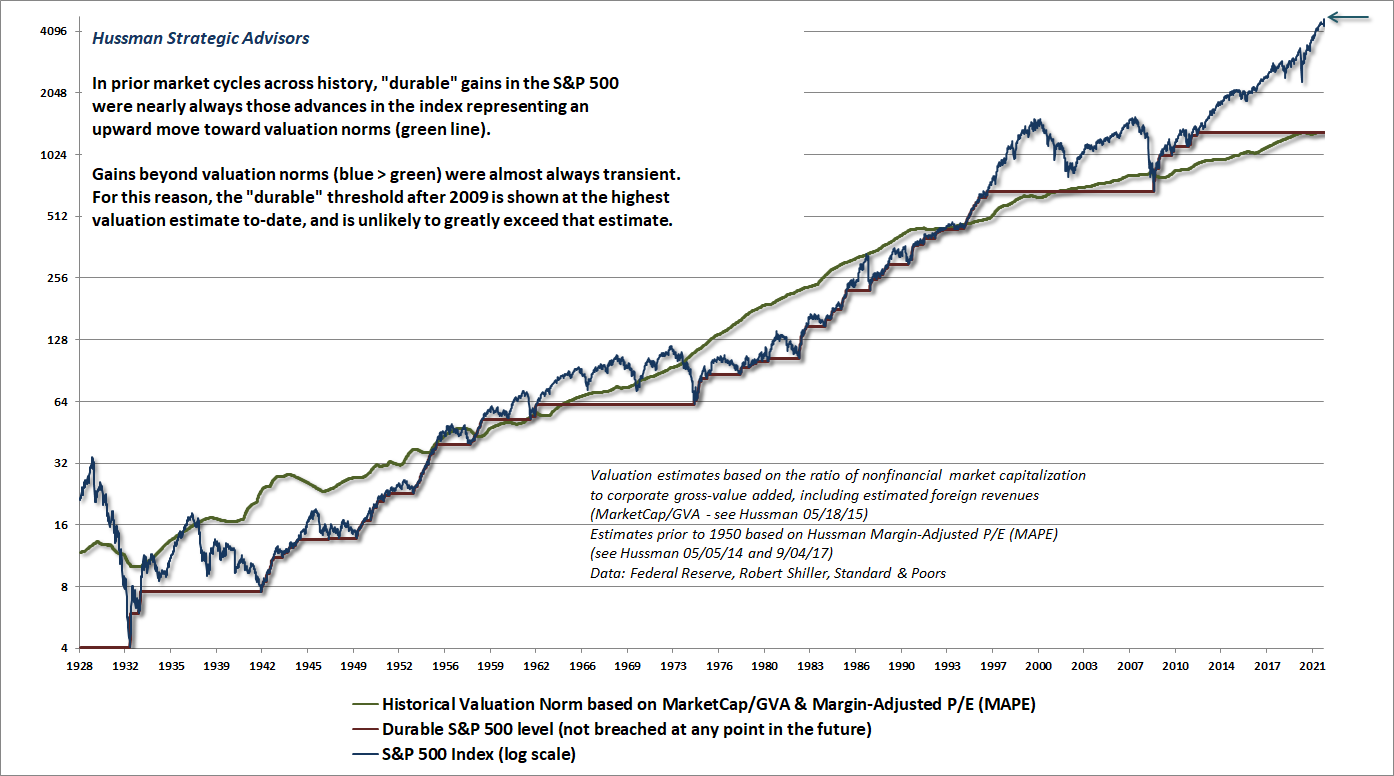

BTW. This has nothing to do with political parties. Everyone has dirty hands on this one.*Note: log scale on the vertical axis. That's important to understand full scale of the risk.

https://www.hussmanfunds.com/comment/mc211120/

https://www.hussmanfunds.com/comment/mc211120/My concerns....

Society is on a knifes edge of devolving into general violence as it is.

This bubble has been inflated to

insane Extinction Level Event levels.

Fed could keep it levitated as long as they could keep rates at 0%.

Inflation is showing signs of not being "transitory".

The Fed would prefer not to raise rates. Pumping unlimited free money is the cocaine that is keeping everything high. Inflation might force their hand.

They'll have to raise rates if inflation doesn't flatten soon.

If they raise rates and the market crashes, they reeled in almost no rates to be able to lower to slow the crash. They have no ammo left to fight a collapse except negative rates, which I'm pretty certain is illegal in the U.S.

China might be the canary in the coal mine or the first domino. Might be a good time to make a try for Taiwan. Focus everyone on an external enemy. Strike while the West in distracted with an economic collapse.

What would a hot-war with China look like in the midst of an 80% market drop and 20% unemployment and 15% inflation?

Next year might be a wild ride before it's over.