Originally posted by SteveBailey

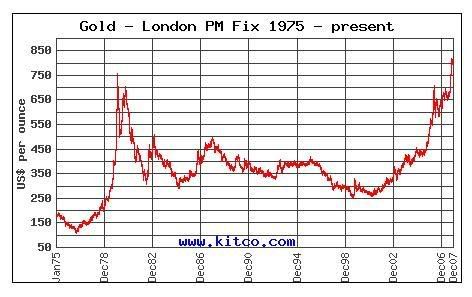

You may want to look at the chart again if you think it's too late.

Gold continues to rise, as it always does in a bear or volatile market.

Typed by SteveBailey a little while ago:

I've added wheat to that since then. We are in for big financial troubles here in the US and a world wide recession, in all likelihood. Many people are blissful in their ignorance as they stick their heads in the sand and ignore the signs.

I am not long in anything at this point, for the reasons you state and also withdrew, and took nice profits, from the market just before the post-Y2K big bear market with the exception of a long position in eBay which paid off very well.

Never held a short position in anything... my ex was a bank VP.

Oil... is just going to keep rising, in my view, as will gold in all likelihood.

I expect to see 200@bbl at some point. I am not sure about a gold ceiling.

I am pretty conservative on investing thus this chart makes me shy away from gold.

curtesy of-->

http://www.kitco.com/scripts/hist_charts/yearly_graphs.plxNote the relative price of gold during the post-Y2K bear market... it was relatively stable... but gold appears to be tracking post-911 paranoia since 2001 in spite of the major bull market of recent years.

I am waiting to see the effects of a lefty administration I expect to see take office in the form of B&H & Co and get a sense of post-911 paranoia after Bush & Co are out of office.

It's all speculation; gold could be the best investment, or not.

That's what makes market investing a lot like gambling, in my opinion.

(I can only be inticed into playing penny poker lol and never bet more than $2 on a pony on rare instances I have been to a track)

I love tech stocks because I am in the tech industry... but collectively there are better investments for the most part since post-Y2K.

TIGERESS