Some highlights from my weekly email “discussion” with my Perma-Bull friend…

So my friend asserts that if the Fed starts tightening and the Stock Market does start to collapse, the Fed will simply reverse and that snap of the fingers will instantly stop any crash, ergo, there can be no significant crash. He says I can’t have it both ways. I can’t claim the Fed pumped us up to these levels , have kept things levitated at these levels, can cause a crash by stopping the printing, yet claim they can’t reverse a collapse by resuming printing again. I can’t have it both ways.

Yes I can.

The Fed has mechanical levers they can actuate to effect markets. But sometimes human psychology at it’s emotion extremes become impervious to Fed intervention for a period of time until people calm down enough to listen to what the Fed is trying to tell them. e.g.

https://www.investopedia.com/terms/i/irrationalexuberance.asphttps://www.investopedia.com/terms/i/inflationarypsychology.asphttps://www.investopedia.com/terms/p/panicselling.aspetc.

The Fed wakes up in cold sweats thinking about markets emotional extremes. That’s when no one listens to them for a while and they are utterly powerless in the face of pure, raw, human emotion. It’s that moment of horror when they try and wiggle the joystick and nothing responds and they realize the control cables have been shot away.

That is not just an opinion I’m pulling out of my ying-yang. I’m staring at the actually historical data from the 2001 and 2008 market crashes. The Fed desperately slashed rates by heroic percentages all through those crashes trying to reverse the collapse with little discernible effect. In fact, maybe no effect. It may just be that those panics simply had to play themselves out.

My friend assets yes they did stop the collapse. They stopped it from going even further. Hmmmm...Okaaaay. But it didn’t stop a 54+% drop in 2008 or a 76+% drop in 2001. I don’t know about you guys, but that is not a ride I want to take so close to retirement. Remembering that it took the NASDAQ 15 years to get back to break-even after DotCom.

My reading of historical data suggests that after a crash, after the markets has wiped away it’s tears and blown their nose, the Fed can nudge investors and tell them,

“Hey man, buck up. Here you want some free money to gamble with? Com’on. You can do it. Borrow on some margin and speculate and make back some of those losses.”

“Sniff..well...ok...sniff...I’ll give it another try.”

When things are trending up, and investors are feeling like Masters of the Universe, the Fed can break out the mirror and lay down another line and hand the market a straw,

“Here ya go my man! Risk-On! Risk-On, Dog!”

“Oh Hell ya! Sniiiiiiiiiiif. I say HELLL YA! THIS TIME IS DIFFERENT!!!!!”

But once some has yelled “FIRE!!!!!” in that crowded strip bar and everyone is stomping each others guts out trying to get to the exit, if the Fed tries to stand in front of them waving free debt to buy on margin risk assets that are going up in smoke all around them, they are going to get punched in the mouth,

“Get the fk out of our way!!!!!! We gotta get out of here!!!!!!!”

Here are couple of data points I suggested my friend should carefully weigh.

* I don’t think Powell is the dove he has appeared to be lately. I think by nature, he is an old school moderate hawk. I think a couple of factors have forced him to lean further dovish than he would have preferred:

1. I think he felt as chairman he had to tilt to the prevailing committee sentiment. The committee has been decidedly dovish and Powell felt it was important for the chairman to not look out of step because a sense of consensus is needed for market stability. I don’t think he felt he had the freedom to vote how he would have voted as a mere governor rather than as a chairman.

2. I think he made a tactical assessment that he had to appear a little dovish to get past his renomination and confirmation. Despite where you see him plotted based on recent voting, I think you will begin to see moderately more hawkish Powell more in line with his true internal beliefs.

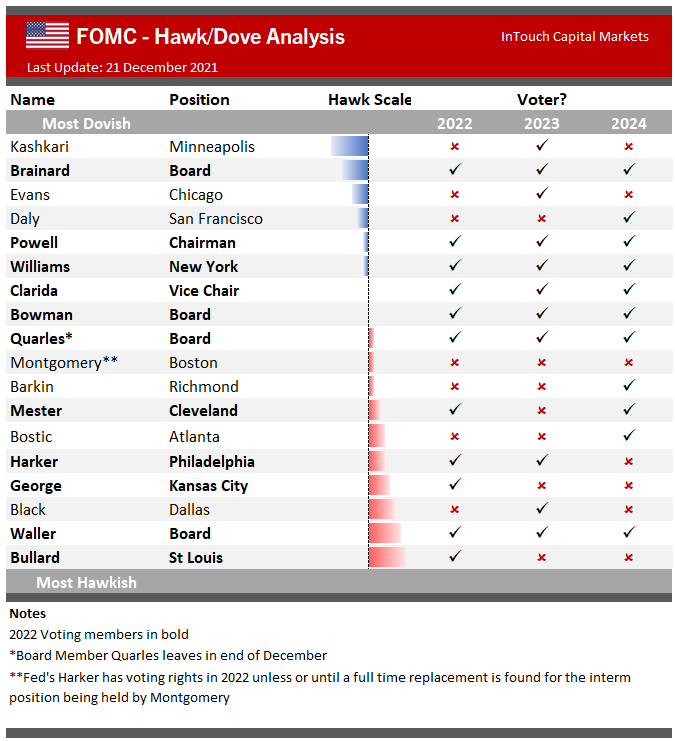

* Not all the Fed governors vote every year. Only a subset. In 2022, the voting slate of governors are rotating to a majority of hawks. I believe Powell will now lean hawkish to show consensus with the hawkish majority.

* Powell has a known concern for excessive wealth inequality in our country and the risks that poses to social cohesion and stability. I find it hard to believe he is going to be comfortable watching average American working families get monkey-pounded by crushing inflation in order to protect the stock market for 10% of the population that own 90% of all risk assets. Especially given the obscene returns they have already seen over the decade in the distorted market.

Good for them. But they should have been taking some of those profits off the table before now. If they haven’t, then maybe they need to learn the lesson of Moral Hazard. People choose to invest in the stock market. No one is forcing them by law. They are called Risk Assets for a reason. It was never intended that there should be a permanent guarantee of extreme profits under all possible circumstances.

Those that are still full Risk-On are either not paying attention, or they are so greedy they are willing to rush in front of an on-coming freight-train to pick up pennies off the tracks. Either way, play stupid games, win stupid prizes.

I’ve personally had enough. I’m Risk-Off. But maybe inflation will disappear magically. I could be totally wrong. If by summer the market has not even blinked, then I will have to re-evaluate and consider DCA back in, but I needed to re-allocate anyway and get much more conservative. I was way over my skis.

Still, Beware the Ides of March: